Xiaomi who has been the second best-selling smartphones manufacturer in China, now see seen an immense drop in the sales of its smartphones during the second quarter of 2016 compared to the same period of 2015. According to the figures released this by research firm IDC, Xiaomi has seen a decline in the sales of smartphones by 40% in China in Q2 2016.

There is no doubt that Chinese market is giving a serious trouble to LG

and HTC like companies but it seems like this sudden loss is here to

flip a new page of the ongoing chapter. Apple Inc. has not been

performing well in China and it seems like something similar has stung

the growth of Xiaomi as well. The company is not performing as good in

its own country as it was once.

On the other hand, other Chinese companies like Huawei, Oppo, and Vivo are all seeing a significant growth in their sales.

Huawei prognosticated its own growth which even made the company to

boldly put a verdict that the company is aiming to become the no. 1

smartphones maker in the next five years. The name and fame that put

glory to the bag of Xiaomi now seem to be fading.

Xiaomi missed the smartphone sales targets twice as well as revenue targets in the last 12 months. According to analyst Richard Windsor, the revenues could drop further 10-20% n 2016 to give Xiaomi a valuation of just $3.6 billion.

This will be indeed a big loss to the revenue of the company. So, what

just happened to the success of Xiaomi that once flattered everyone?

Xiaomi’s sudden drop in sales and revenue goes parallel with its success.

The Chinese company attained the success almost at the same pace. But,

the latest reports convey that the company not able to maintain the

success. The company that produces smartphones with premium hardware and

features at affordable prices failed to maintain its charm. The only

reason behind the same is ought to be the entry of other smartphone manufacturers who follow the same trend and started gaining the success at a very early stage.

However, unlike Xiaomi, its competitors were able to push a new idea. For instance, Vivo

offered curved screens. Oppo and OnePlus stayed tight with the rapid

charging. LeEco offered exclusive content and, Huawei’s dual camera

concept attracted many.

Neil Shah, analyst with CounterPoint Research told IBTimes UK,

"I think Xiaomi's current performance and growth in the smartphone space has stalled, as competitors with better R&D, vertical manufacturing expertise, and a wider distribution and geographic footprint has surpassed the brand. Xiaomi's inability to innovate independently is one of the key reasons."

Another strong reason is that Xiaomi has been only playing in the Asian countries.

Had it showed its presence in Western Europe and the United States, it

would have become the nominee at least, as a global player. The biggest

hitch is, Xiaomi doesn’t hold any patent portfolio to enter any of these

markets. However, a few hearsays reveal that Xiaomi is planning to enter the US market in the near future employing the same online sales and marketing tactics.

Currently, the company is unprepared to enter a more mature market. The second biggest problem is its long accused of copying hardware and features of established players like Apple and Samsung.

As said earlier as well, Xiaomi has been targeting only the Asian countries and this has paid off the company really well. The smartphone sales in India have grown by 72% in the last two years.

Xiaomi India Head Manu Jain told PTI –

"We entered India in July 2014 and disrupted the smartphone industry with high-quality devices. We have since then seen an incredible growth rate of 72 per cent year-on-year (July 2014 to July 2016) in terms of smartphone sales.”

He, however, declined to comment on the total number of handsets sold by the company.

The company also sells other products and accessories

like tablets, power banks, and Bluetooth speakers in India. So, it’s

difficult to know the growth of the company in different areas.

Xiaomi that once ruled the Chinese market is watching

a decline in its growth. We are keenly watching the performance of the

company and want to see if the outcome matches the predictions of

analysts.

Ref;https://www.mobilescout.com/xiaomi/news/n72416/xiaomi-sudden-loss-40-bn-dollar-q2-2016.html

Why the ‘Apple of China’ Is Losing Its Luster–In One Chart

Jun 24, 2016

Xiaomi

CEO Lei Jun promotes his company’s smartphones at a product-release

event in Beijing. Smartphones account for more than 90% of Xiaomi’s

revenue. Zhang Jin Xinhua—Eyevine/Redux

At

the beginning of 2015, Chinese smartphone maker Xiaomi looked like a

juggernaut in the making. The company's cheap, stylish handsets were

selling fast and earning rave reviews. Its executives had launched their

plan to compete globally with the likes of Apple, Google

and Samsung by rolling out an "ecosystem" of music, apps and

Internet-of-Things products. And Xiaomi had just finished a fundraising

round that valued the company at $45 billion--making it, at the time,

the world's most valuable privately held "unicorn."

Less than 18 months later, as Fortune reports in a feature story this week,

Xiaomi euphoria has screeched to a halt. A company official recently

said the company had generated only $12.5 billion in sales last year,

well below the $16 billion that CEO Lei Jun had predicted. Skeptics

increasingly doubt that Xiaomi will live up to its hype--and plummeting

smartphone sales are a big reason why.

Back

at the beginning of 2015, Xiaomi's Lei announced a smartphone sales

goal of 100 million units for the year. The company ultimately shipped

only 71 million, according to IDC. Xiaomi isn't alone in its

predicament, because global smartphone sales have stalled. (That phenomenon has hurt Apple, too.)

But Xiaomi's sales have fallen farther and faster than those of many

rivals: In the first quarter of 2016, Xiaomi shipped only 10.9 million

phones, a 26% year-over-year decline.

Quality

problems may be contributing to the steep drop-off. Some Mi phone users

have been lamenting publicly about cracked screens and static from

earphone slots. And Xiaomi’s newest flagship phone, the Mi 5, has

attracted complaints since its release in March, with buyers reporting

that new handsets often reached a scorching 120˚ F. Xiaomi says the

handset problems involve “isolated cases” and says, “We do investigate

all reasonable complaints.” But the phones’ perceived unreliability has

had an impact. Clark, the Internet consultant, recently surveyed phone

owners in China. Only 37% of Xiaomi owners said they would buy another

Xiaomi phone, while 74% of Apple users said they would get another

iPhone.

The

company's falling smartphone sales have only drawn more attention to

the fact that Xiaomi's ecosystem hasn't gotten very far off the ground.

Company officials say they think sales of everything from Xiaomi fitness

bands to Xiaomi rice cookers could equal their smartphone sales five

years from now. But as Fortune explains in "Can Xiaomi Live Up to Its $45 Billion Hype?" that may be even more of a long shot than catching Apple would be.

Ref:http://fortune.com/2016/06/24/xiaomi-trouble-one-chart/

The Xiaomi shock!

China’s booming smartphone market has spawned a genuine innovator

“FROM

the beginning, Xiaomi has considered the mobile phone to be a converged

gadget of software, internet services and hardware, not just a simple

device.” So declared Lei Jun, the charismatic founder of Xiaomi, a

Chinese smartphone-maker with global aspirations, during a recent

meeting at his firm’s headquarters in Beijing with Choi Yang-hee, South

Korea’s telecoms minister.

Bland as Mr Lei’s

comments may sound, the meeting revealed something important about

Xiaomi. That a South Korean minister would deign to visit a Chinese tech

firm which until recently was barely known outside its home country,

let alone sit through such a lecture, is telling. Such has been the

Korean hubris over the prowess of its chaebol—most

notably Samsung, the world’s leading mobile-phone firm—that the scene

would have been unimaginable just a few years ago. It shows how worried

Samsung is of being upended by what another South Korean minister has

called the “Xiaomi shock”.

To

see what he means, consider what the firm has accomplished since its

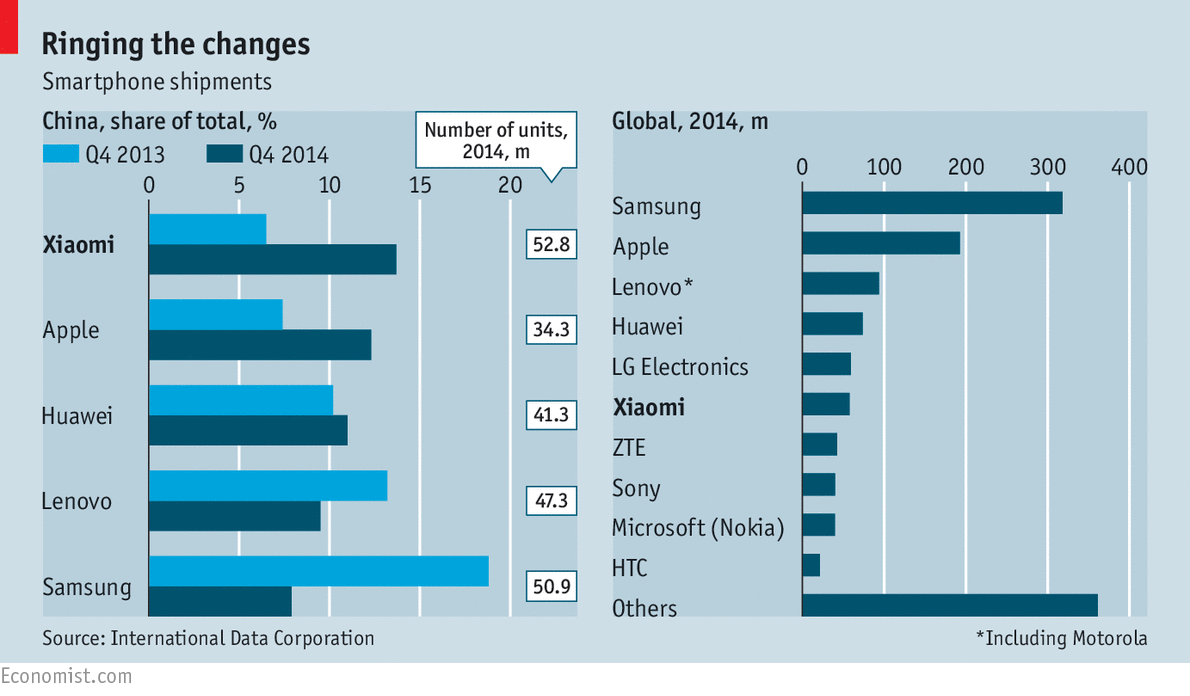

first phone was launched four years ago. Its worldwide sales were 61m

handsets last year, a rise of 227% on the year earlier, making it the

sixth-biggest mobile-phone firm in the world. In China, Xiaomi had leapt

ahead of all its rivals, foreign and local, by the final quarter of

last year, to become the top-selling brand of smartphones (see charts).

This year Mr Lei wants to sell 100m units worldwide.

The

company has already started a big push towards achieving this. Last

year it began selling phones in a few South-East Asian markets,

including Singapore. It also struck a deal with Flipkart, India’s

leading e-commerce firm, to sell handsets in that market. Earlier this

month it unveiled plans to sell headphones and other accessories (though

not yet phones) in America.

Conquering the world

will be harder than dominating the home market. Google and its Android

app store are unavailable in China, making it easier for Xiaomi’s

flavour of the Android operating system, and its app store, to flourish

there. Few consumers in other emerging markets are as plugged into

e-commerce as the Chinese are. Entering such markets may require Xiaomi,

which has thus far relied mostly on internet sales and word-of-mouth

buzz, to make expensive investments in advertising and in

bricks-and-mortar retailing.

Profitability

is also a big concern. Xiaomi, still private, releases few details of

its finances. But Mark Li of Sanford C. Bernstein, a research firm,

suspects that its handsets do not make the sort of double-digit margins

earned by Apple. Even the firm admits it has enjoyed higher margins from

selling millions of fluffy promotional toys—in the form of a bunny

called “Mitu”—than it has from handsets.

Another

snag is its lack of intellectual property. Smartphone companies are

highly litigious. Unlike its more experienced local rivals, Lenovo

(which has bought Motorola’s smartphone division from Google) and

Huawei, Xiaomi does not have a huge patent portfolio. Lin Bin, its

president, says it has been filing thousands of patents in preparation

for a legal onslaught: “This is something we expect to happen.” Indeed,

an Indian court is investigating claims that Xiaomi has disobeyed its

order to halt sales of some of its phones in the country, over a patent

dispute.

Given these obstacles, why is Samsung

still worried? One reason is that Xiaomi has positioned itself perfectly

to be a disrupter of firms offering overpriced, over-elaborate devices.

Its best handsets are not quite as good as Apple’s or Samsung’s best,

but they are far better than those from other, cut-rate rivals—and they

cost half what an unsubsidised new iPhone does.

Consider

again the sweeping assertion made by Mr Lei to the Korean minister.

From the start he has understood the awesome power of the connected

mobile device. That has led to a business model that blends Apple’s

walled garden, which encourages users to stay loyal to its “ecosystem”

of apps, with Amazon’s use of the Kindle as a loss-leader to sell

lucrative content, software and services. Xiaomi started off peddling

handsets without profit, but it is creating a bunch of apps, “smart

home” gadgetry, online video and peripheral devices to make a return on

its investment.

The other reason incumbents should

worry about Xiaomi is its financial firepower. Some 29 banks tripped

over themselves to offer it a $1 billion loan in October. In December

several respected venture capitalists including GIC, Singapore’s

sovereign-wealth fund, and DST of Russia, an early investor in Facebook,

provided another $1.1 billion. Some reckon that this latest investment,

which values it at $45 billion, makes the Chinese upstart the world’s

most valuable startup. Xiaomi’s shock-and-awe campaign rolls on.

Ref:https://www.economist.com/news/business/21645217-chinas-booming-smartphone-market-has-spawned-genuine-innovator-xiaomi-shock

No comments:

Post a Comment